This is typically the most affordable type of reverse mortgage. They must be used to pay for a specific, lender-approved item. These reverse mortgages are offered by state, local and nonprofit agencies. There are several different kinds of reverse mortgages including: However, if a reverse mortgage exceeds 60% of the home’s value, the premium can increase to 2.5% of the loan amount.

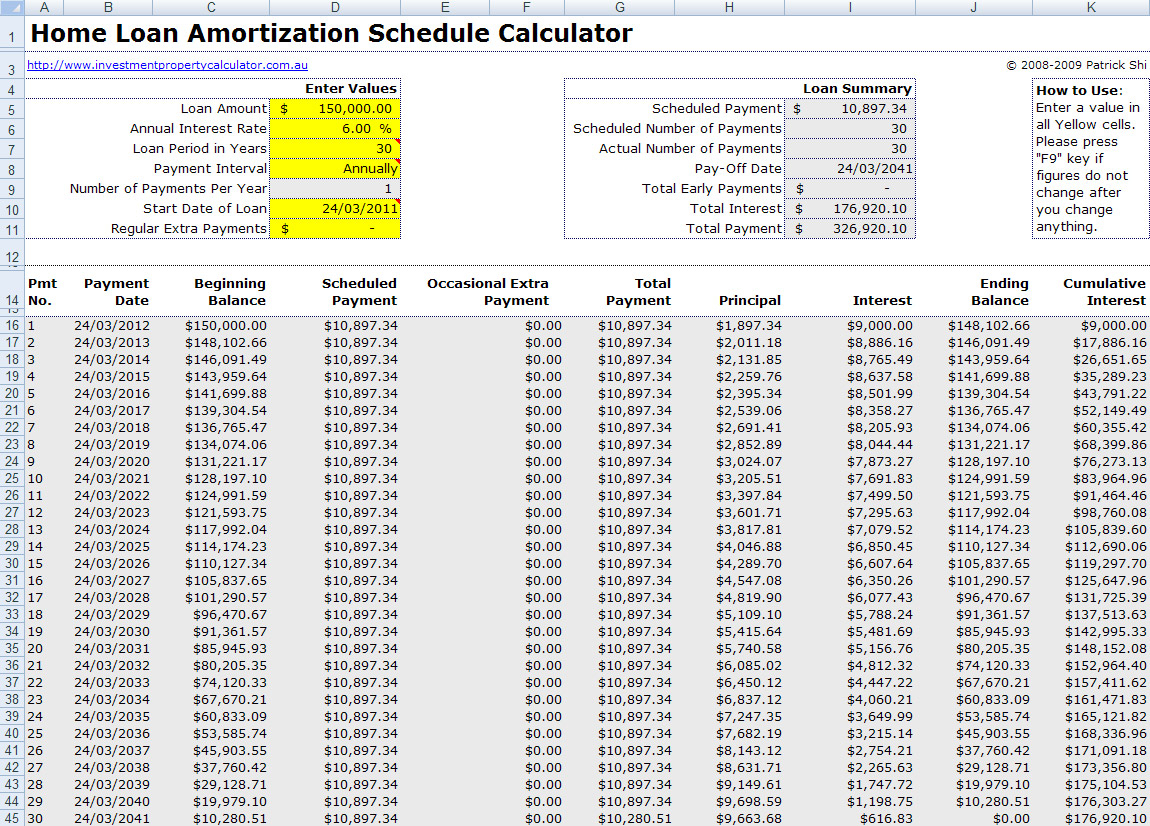

For loans equal to 60% or less of the home’s appraised value, this premium typically equals 0.5%. Reverse mortgages often come with high fees and closing costs, and a potentially costly mortgage insurance premium. If the borrower dies, the estate (or heir to the estate) must pay back the loan, but not more than the value of the house. If the homeowner moves out before the loan is repaid, there is a one-year window to close out the loan. Because you’re not making monthly payments like a traditional mortgage, interest and fees keep accruing so the balance goes up, rather than down. Like the term itself, reverse mortgages work the opposite of a traditional mortgage in that payment does not typically occur until the home is sold, either because the borrower moved out or died. The loan balance is not paid until the home is sold, either because the borrower moved or passed away. Unlike a traditional mortgage where the balance decreases over time as you make payments, with a reverse mortgage, that balance increases as interest and fees are added on a monthly basis. Reverse mortgage funds, which are only available on primary residences and to people over the age of 62, are structured as lump sums or lines of credit that can be accessed on an as-needed basis. What Is a Reverse Mortgage?Ī reverse mortgage is a lending option that lets homeowners who’ve paid off all or most of their mortgage to tap into their home equity. If you think a reverse mortgage might help you stay in your home through retirement, make sure you understand the risks and rewards so you can make a better-informed decision. Reverse mortgages can also come with variable interest rates so your overall costs could increase down the road. Reverse mortgage lenders impose high fees and closing costs, and borrowers must pay for mortgage insurance. However, reverse mortgages come at a cost, so it’s critical to know all the terms upfront. A reverse mortgage may seem enticing if you’re retired and struggling with expenses on a fixed income.

0 kommentar(er)

0 kommentar(er)